How Much Will Social Security Checks Go Up In 2025

How Much Will Social Security Checks Go Up In 2025. The earnings limit for people reaching their “full” retirement age in 2025 will increase to $59,520. How much are social security payments in 2025?

How much is the increase: The government wouldn’t make any adjustments for your claiming age when calculating your new benefit, so your 2025 checks would rise by 3.2%, or about $59 per.

The maximum amount of earnings subject to social security payroll taxes will be $168,600 for 2025, up from $160,200 for 2025.

In 2025, average monthly payments for retired workers rose to just over $1,900, according to the ssa.

How Much Will Social Security Checks Go Up in 2025 Expert Analysis, The $21,756 social security bonus most retirees completely overlook if you're like most americans, you're a few years (or more) behind on your retirement savings. (we deduct $1 from benefits for each $3 earned over $59,520 until the month.

When and how much will Social Security checks go up? raise coming soon, All social security recipients saw a 3.2 percent cost of living adjustment in 2025 to make up for the impact of inflation on their benefits. As of now, tscl forecasts the 2025 cola will be 2.6%.

How Much Social Security Checks Will Increase in 2025 Northwestern Mutual, This means larger checks to the more than 66. This means benefits will increase by 3.2%.

Social Security Checks in 2025 Up to 4,691 Benefits After 3 COLA, More than 71 million americans will see a 3.2% increase in their social security benefits and supplemental security income (ssi) payments in 2025. Social security benefits and supplemental security income (ssi) payments for more than 71 million americans will increase by 3.2% in 2025.

Here's How Much Social Security Benefits Could Increase in 2025 Monthly, The average check is set to increase by about $59 per. The estimated average social security benefit for retired workers in 2025 is $1,907 per month.

Your Social Security check will get a 2.8 boost in 2019, This is because the usual payment date of june 1 falls on a. More than 71 million americans will see a 3.2% increase in their social security benefits and supplemental security income (ssi) payments in 2025.

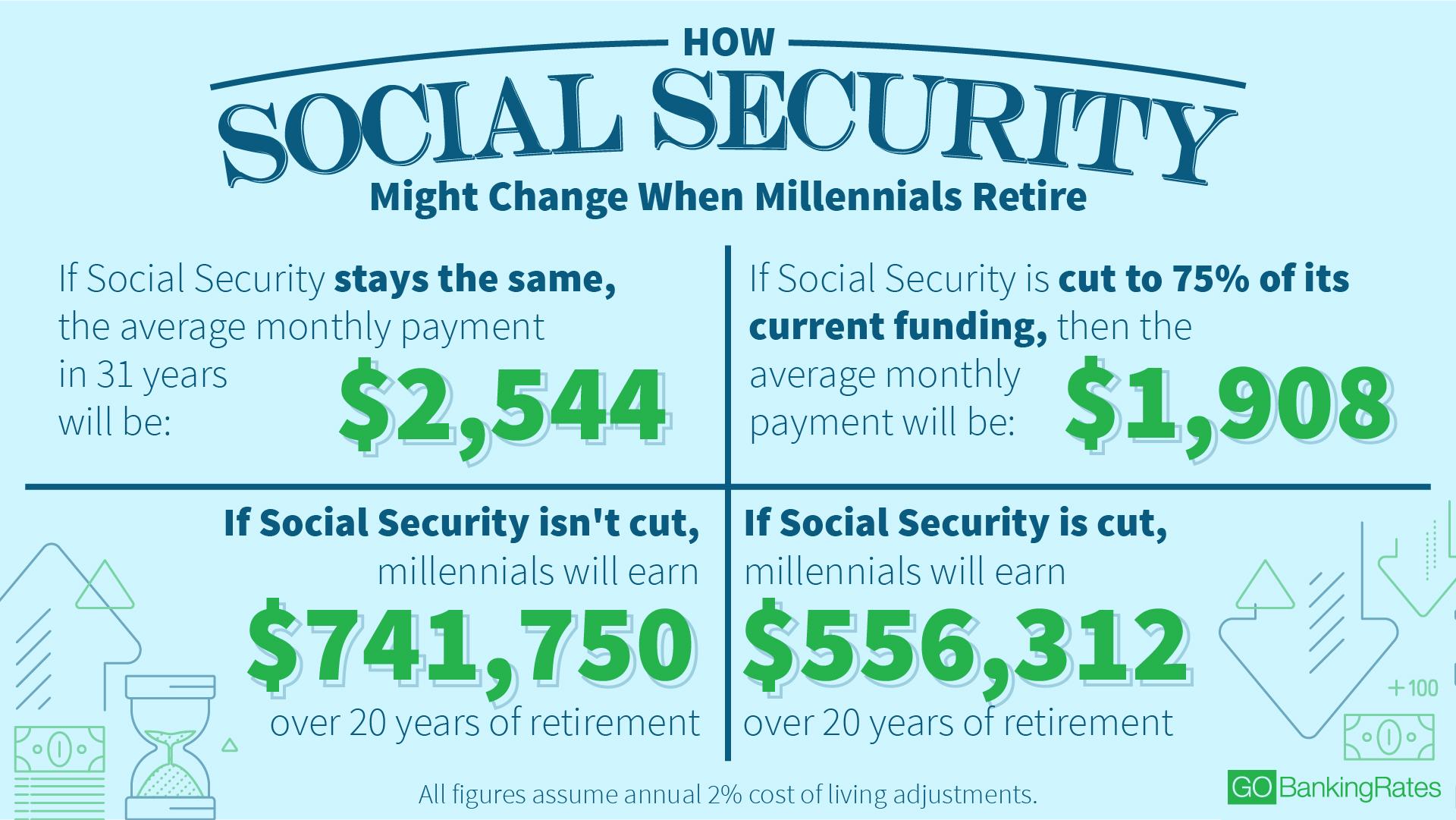

Here's What Social Security Will Look Like by the Time Millennials, For may only, ssi recipients will receive their payments for june on the final day of this month. All social security recipients saw a 3.2 percent cost of living adjustment in 2025 to make up for the impact of inflation on their benefits.

Social Security COLA 2025 MaryleeRenee, How much will your social security checks increase in 2025? This means benefits will increase by 3.2%.

How Much Social Security Will I Get? How To Find Out YouTube, For may only, ssi recipients will receive their payments for june on the final day of this month. The maximum amount of earnings subject to social security payroll taxes will be $168,600 for 2025, up from $160,200 for 2025.

Does it Matter if Social Security Checks are Delayed YouTube, There is no change in the social security tax, but the. Social security benefits and supplemental security income (ssi) payments for more than 71 million americans will increase by 3.2% in 2025.

All social security recipients saw a 3.2 percent cost of living adjustment in 2025 to make up for the impact of inflation on their benefits.