Missouri Income Tax Withholding Tables 2025

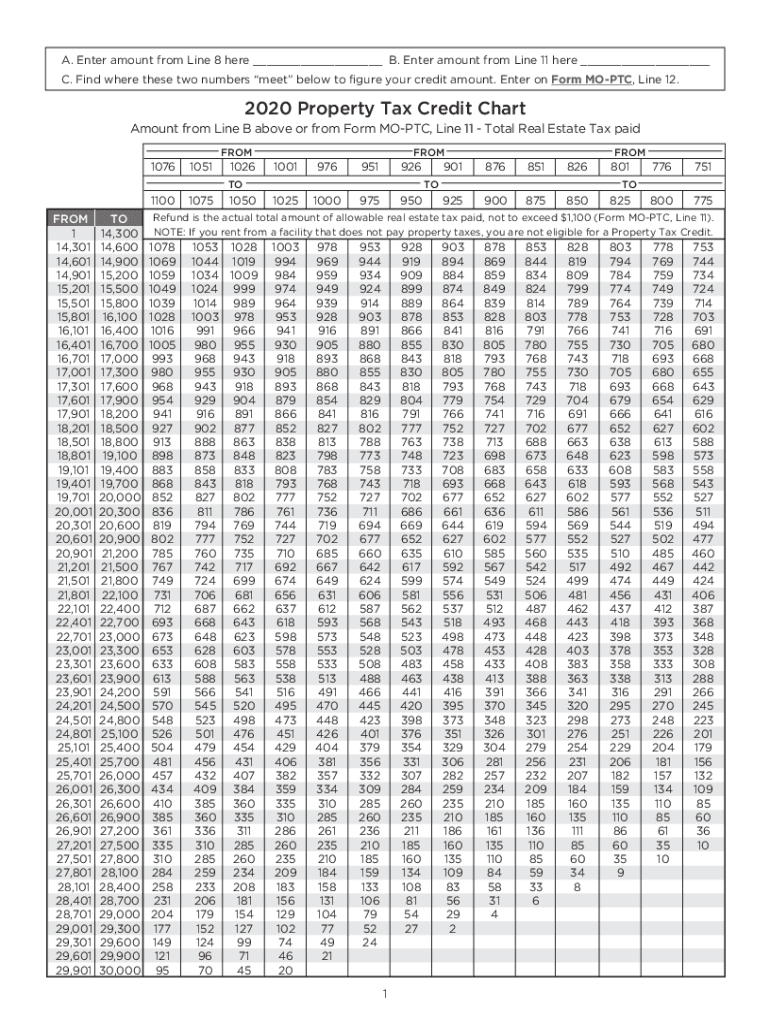

Missouri Income Tax Withholding Tables 2025. 1, 2025 published the 2025 withholding tax formula for corporate income and individual income tax purposes. State payroll taxes include income tax, unemployment tax, and in some states and cities, local taxes.

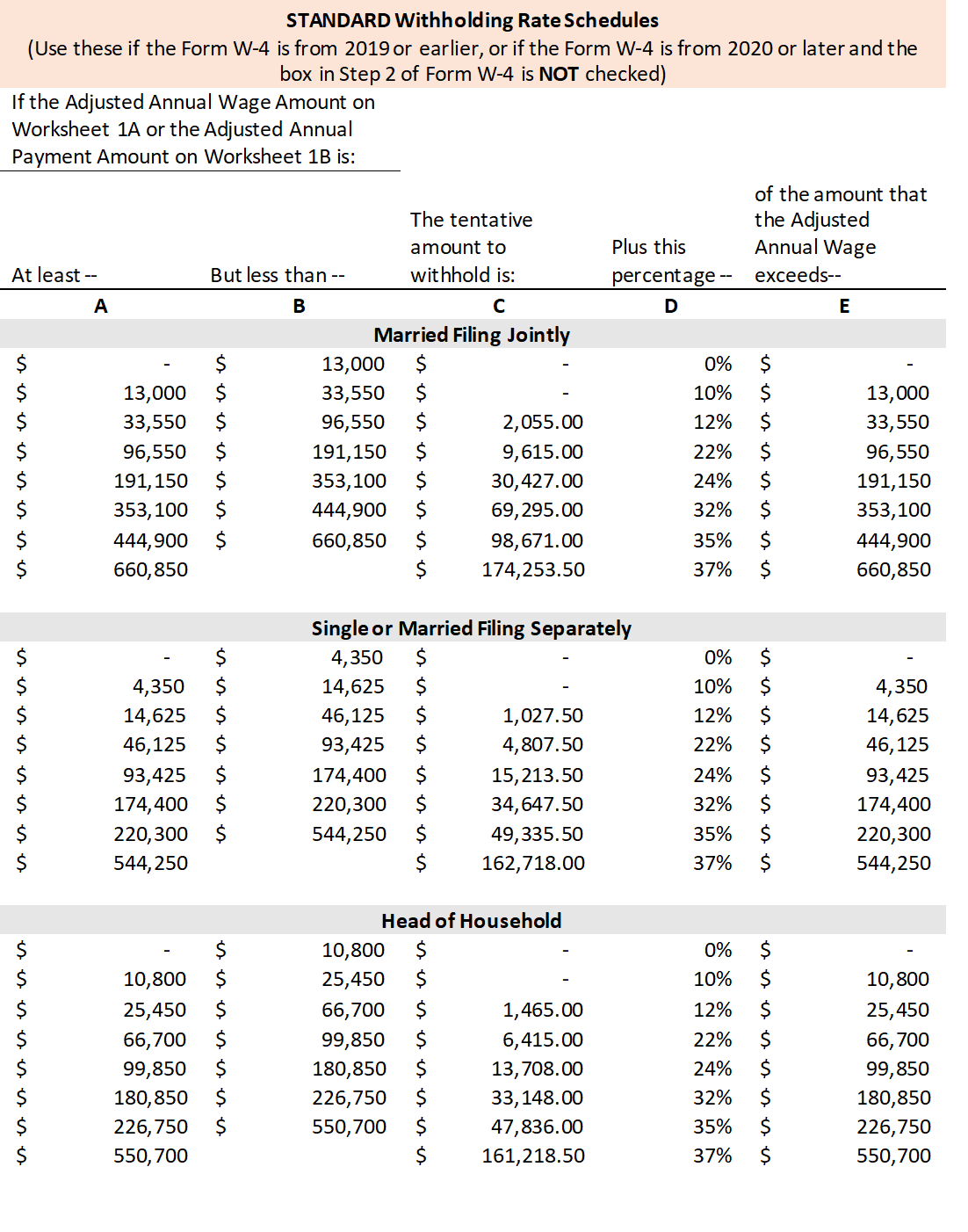

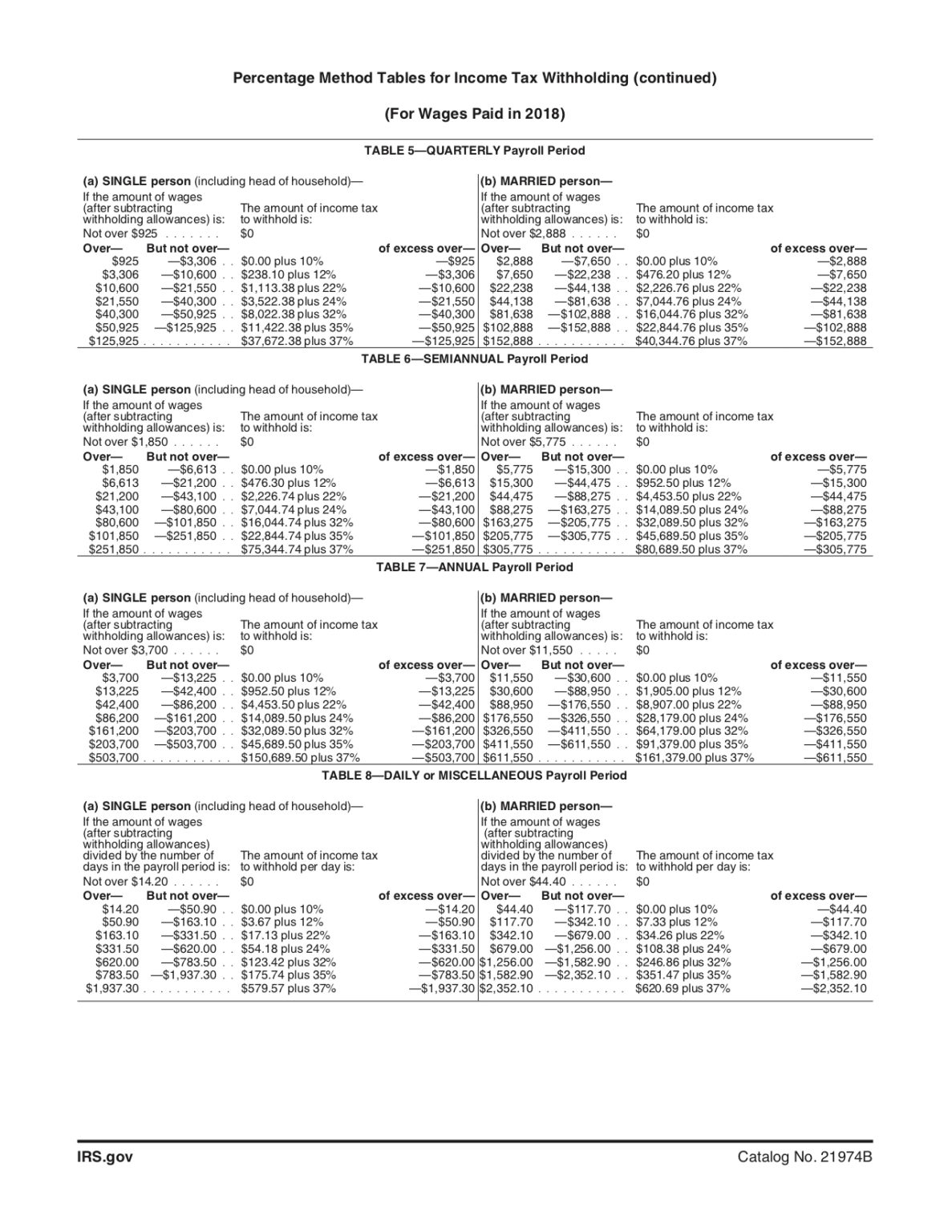

Department of the treasury internal revenue service. How to calculate 2025 missouri state income tax by using state income tax table.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, The standard deduction for a. The salary tax calculator for missouri income tax calculations.

Withholding Tables Calculator, Income tax withholding formula/tables1 supplemental withholding rate flat income tax withholding rate highest marginal income tax withholding rate2 4.7% in 2025, 4.4% in. Missouri’s income tax rates decreased in its 2025 withholding formula, which was released nov.

20242024 Tax Calculator Teena Genvieve, The standard deduction for a. Department of the treasury internal revenue service.

Maximize Your Paycheck Understanding FICA Tax in 2025, Updated for 2025 with income tax and social security deductables. Income tax tables and other tax information is.

Missouri Tax Withholding Tables 2025 Federal Withholding, 1, 2025 published the 2025 withholding tax formula for corporate income and individual income tax purposes. Over $1,207 but not over $2,414.

How to Calculate Payroll Taxes, Methods, Examples, & More (2025), You can quickly estimate your missouri state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to compare salaries in. Income from $ 2,546.01 :

Eic table 2025 pdf Fill out & sign online DocHub, The rate was cut to 4% in. The tables provide information based on daily,.

T130159 Baseline Distribution of and Federal Taxes; by, How to calculate 2025 missouri state income tax by using state income tax table. Over $0 but not over $1,207.

Withholding Tax Table, Income tax withholding formula/tables1 supplemental withholding rate flat income tax withholding rate highest marginal income tax withholding rate2 4.7% in 2025, 4.4% in. Income from $ 1,273.01 :